The availability of Bitcoin (BTC) on Over-the-Counter (OTC) desks has sharply decreased, with reports suggesting that at one point, only about 40 BTC were available for sale. This news has significant implications for the market and could herald a new era in BTC trading dynamics.

OTC Desks Had 40 Bitcoin Available On Wednesday

Caitlin Long, the CEO and founder of Custodia Bank, provided an eye-opening account of the current state of the OTC Bitcoin market. Through a series of posts on X (formerly Twitter), Long noted, “The #HODLgang has mostly held…I spent time in NYC over the past couple of days and it’s clear why the Bitcoin price spiked this week: there was almost no BTC available for sale on the big OTC desks.”

Echoing Long’s observations, Samuel Andrew, a noted figure in the crypto space, added, “OTC desks are nearly dried up. Very little Bitcoin available that’s easily accessible to meet demand. BlackRock and Fidelity are moving size in ways crypto has never seen before.” Long added:

Only ~40 BTC were available for sale at any price at one point on Wednesday, I was told by a credible source…

This scarcity of BTC on OTC desks is not an isolated incident but part of a broader trend indicating a significant shift in the market. Glassnode, a leading blockchain data and analytics firm, reported that Bitcoins held by OTC desks are at their lowest level in five years. Although Glassnode tracks only a portion of the OTC market, the data points to a clear trend of dwindling BTC availability.

What This Means For BTC Price

The implications of this trend are manifold. Firstly, it suggests a potential supply shock in the Bitcoin market, driven by increased demand from institutional investors and large corporations looking to add Bitcoin to their portfolios, as well as the introduction of spot Bitcoin ETFs. This supply shock could lead to a shift in price discovery from OTC desks to public exchanges, where the real market price of Bitcoin will be determined more transparently.

The shortage of Bitcoin on OTC desks also means that large investors and ETFs like BlackRock and Fidelity, who traditionally bought Bitcoin in bulk at a discount through these desks, may no longer have this option. This could further drive demand on public exchanges, potentially leading to significant price movements.

Analysts are already speculating on the possible outcomes of this situation. Alessandro Ottaviani, a prominent analyst, suggested, “After today, god candles ($10k in the daily), before the halving are possible and realistic.”

This sentiment was echoed by Francis Pouliot, CEO of Bull Bitcoin, who remarked on the self-correcting nature of the market: “OTC desks like http://BULLBITCOIN.COM never run out of Bitcoin. The price goes up, and people sell. If people don’t sell, the price goes up more.”

Adam Back, a Bitcoin OG and cypherpunk, provided a bullish outlook, stating, “$100k by halving day. People starting to believe. Bears, leveraged shorts rekt, scared-off, profit take limit orders moved upwards or just deleted to wait-and-see; OTC desks out of coins, daily $500m / 10k BTC ETF buy walls. This can gap upwards fast. 51 days to go [until Halving].”

In conclusion, the depletion of BTC supply on OTC desks marks a pivotal moment for the market. With the upcoming halving event in April and institutional interest at an all-time high, the stage is set for potentially unprecedented movements in the Bitcoin market.

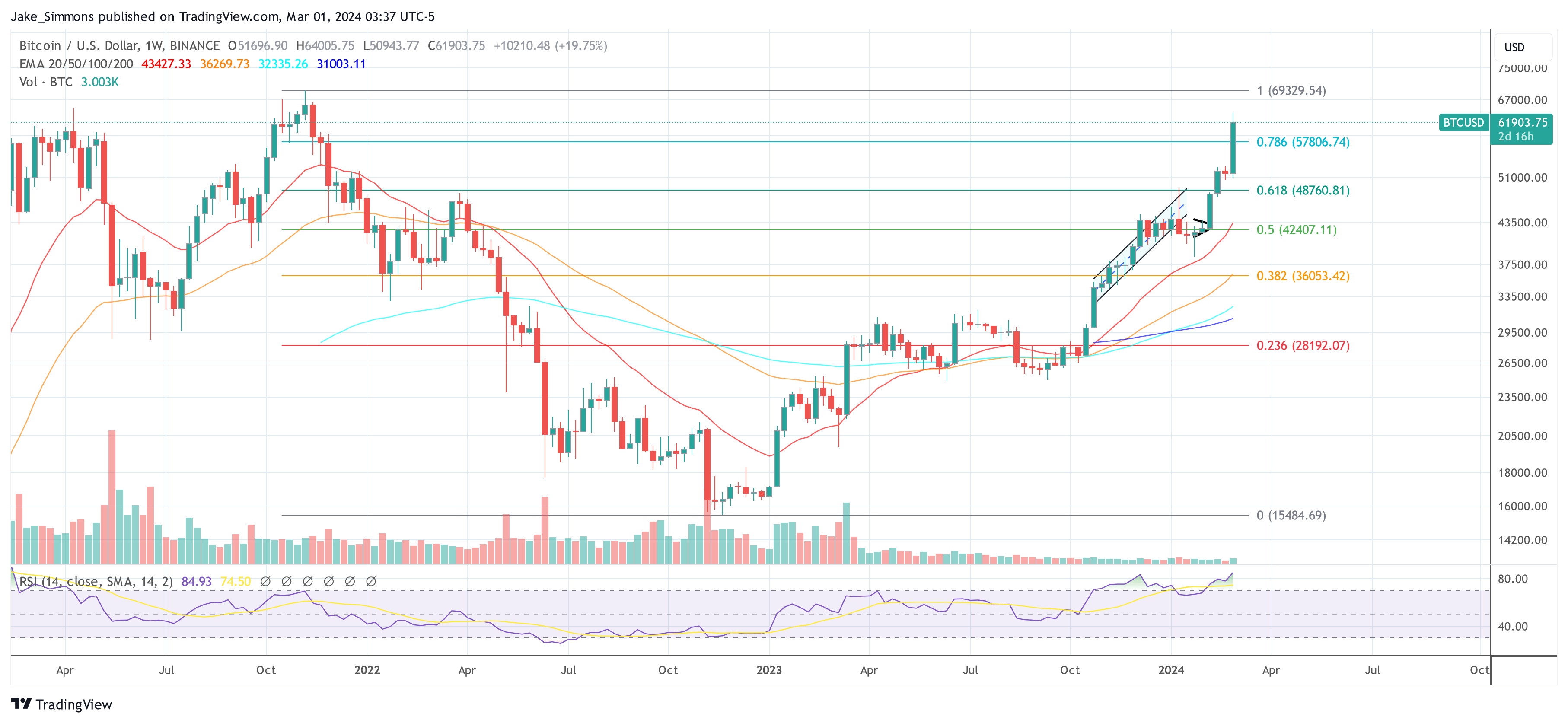

At press time, BTC traded at $61,903.

Featured image created with DALLE, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.