Raghav Poddar was studying computer science at Columbia University when he became intrigued by the challenges restaurant owners were facing maintaining an online presence. A self-described “foodie,” Poddar — who didn’t have much time to cook meals — was a heavy user of food delivery and pickup services in New York City.

“Many restaurants don’t have much of an online presence, but they have the ability to cook more dishes and cuisines representative of their communities,” Poddar told TechCrunch in an email interview. “There might be a broader slowdown in tech, but restaurants need to adopt and become good at technology now more than ever to protect their margins and grow their sales.”

The importance of an online footprint in the restaurant industry — and a quality one at that — can’t be overstated. According to one recent survey, 77% of diners visit a restaurant’s website before they dine in or order out from the establishment. Of that group, nearly 70% have been discouraged or otherwise deterred from visiting the restaurant because of its website.

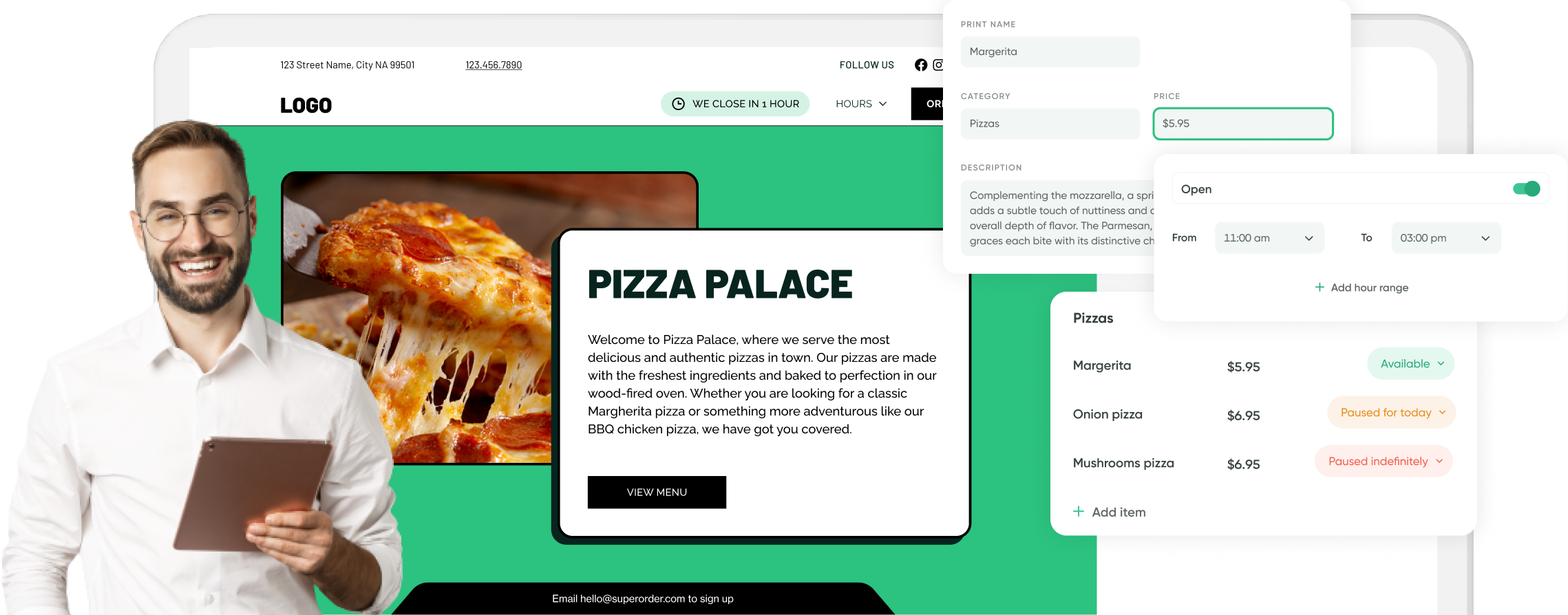

Poddar came up with a solution in Superorder (formerly Forward Kitchens), a platform that provides websites, menus, photos and tools for order management, marketing, financial management and more to restaurants. Superorder today announced that it raised $10 million in a funding round led by Foundation Capital with participation from Y Combinator managing director Michael Seibel, Cruise co-founders Kyle Vogt and Daniel Kan, I2BF Global Ventures and others.

The crux of Superorder’s mission is helping restaurants to boost business from “off-premise” dining — that is to say, delivery and pickup services. The pandemic supercharged the growth of off-premise dining as restaurants were forced to pivot; two-thirds of adults say that they’re more likely to order takeout food from a restaurant than they were before the pandemic, Restaurant.org reports.

But Poddar argues that many restaurateurs, newly burdened by digital managerial tasks, are still leaving money on the table.

“The increased adoption of technology by restaurant owners doesn’t solve the challenges of setting up, managing and understanding how to leverage this technology,” he said. “A task as simple as changing hours on all delivery platforms (e.g. Grubhub, UberEats) for a day can take dozens of clicks and hours of time.”

Superorder attempts to streamline things by letting restaurants set up an online presence, including food delivery, where they can create multiple digital storefronts and accompanying financials and operations dashboards without having to contact each delivery platform.

Image Credits: Superorder

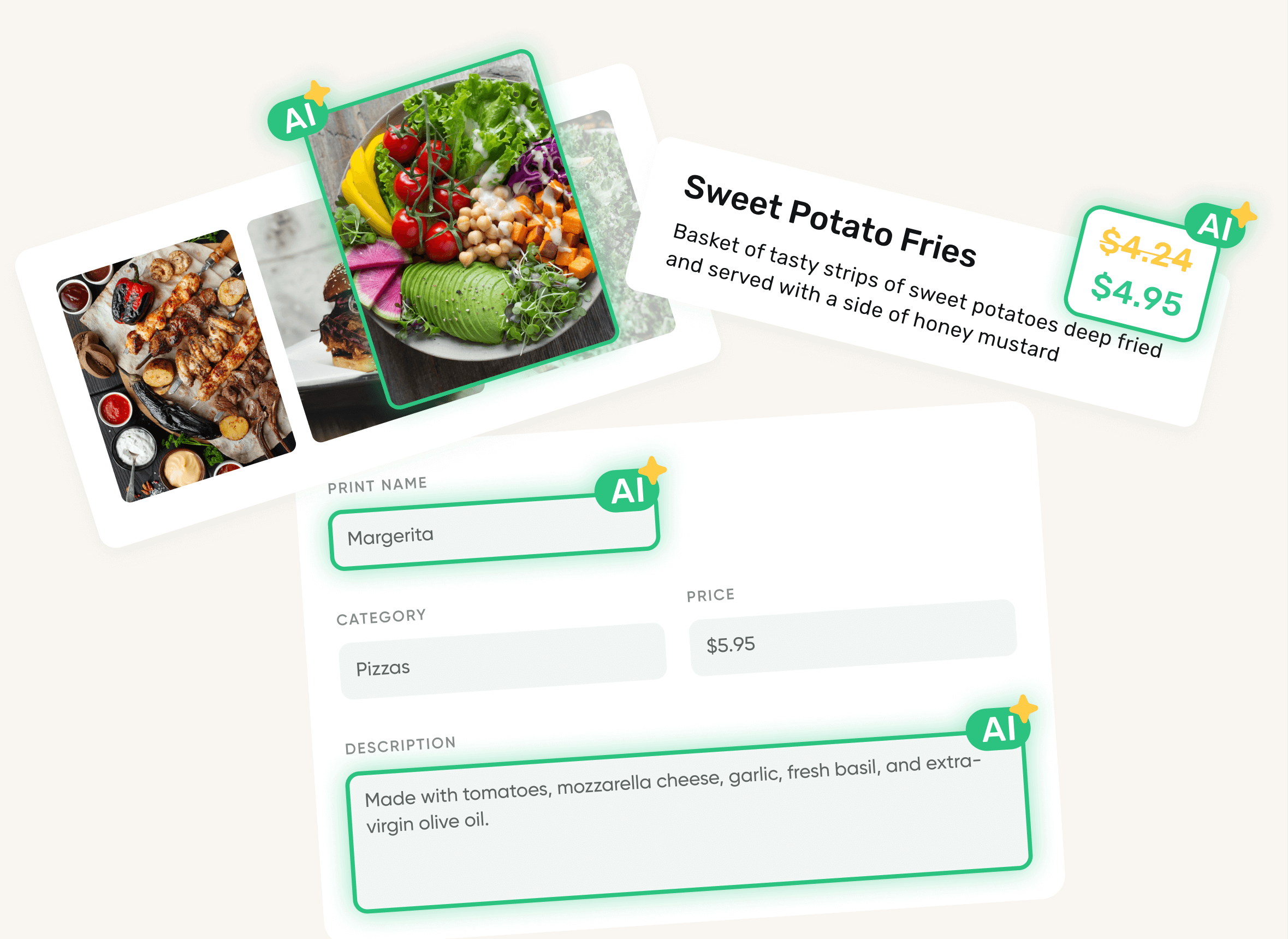

Superorder also consults with restaurants, helping them to launch “virtual restaurants,” or storefronts for different brands operating within their kitchens. Poddar says that Superorder employs data science to identify in-demand dishes in a restaurant’s delivery radius and works with the restaurant to create menus and photos for that brand, which Superorder then lists on third-party delivery platforms.

It’s worth noting that virtual restaurants or “ghost kitchens,” a concept that grew in popularity during the pandemic, don’t exactly have high success rates.

Restaurants often struggle with the cost of finding additional delivery people for their virtual restaurants, affording labor and marketing a location that’s virtually invisible to the public. And some third-party delivery platforms have pushed back against virtual restaurants, accusing the restaurants creating them of spamming the platforms with repetitive listings and menus. As of March, UberEats requires virtual kitchens to maintain a high average rating — above 4.3 stars — and a low percentage of canceled orders.

But Superorder claims that it’s more thoughtful in its approach to creating virtual kitchens than its competitors. For one, the platform uses generative AI to create menus and photos for each virtual restaurant listing, similar to tools offered by restaurant tech startups Swipeby and Lunchbox. Data from Grubhub reveals that restaurants with pictures for their menu items receive at least 70% more orders and 65% higher sales than those without pictures.

Of course, one wonders how closely the AI-generated images resemble the actual menu items. Gross inaccuracies could land restaurants on the hook for lawsuits over false advertising. But Poddar brushes these concerns aside, pitching Superorder’s generative AI as a way for restaurants to provide images “close to” real food visuals without avoid having to hire a professional food photographer.

“Our competitors use the same brand across hundreds of restaurants, creating a ‘one-to-hundreds’ relationship — preventing restaurants from controlling the brand’s quality, image and relationship with their customers,” Poddar said. “With Superorder, restaurants can build a website through a search-based interface by typing in a query like ‘Build me a website for an Italian restaurant in New York’ and picking a design template. And they can create compelling food imagery assets and craft well-written, creative menu descriptions and item names with a simple click.”

“Well-written” and “creative” is up for debate, too, given generative AI’s obvious rhetorical limitations. I’d worry about accuracy; after all, generative AI has a tendency to invent facts.

Somewhat concerningly, it’s also not clear what’s powering Superorder’s generative AI features — i.e. whether the AI models were developed in-house or using a third-party API. The former could be more error-prone; we’ve asked Superorder for clarification.

Image Credits: Superorder

But other aspects of Superorder’s platform seem unequivocally useful, like an order management module that consolidates orders from all third-party delivery platforms into a single pane of glass. Superorder also synchronizes menus across platforms while optimizing menu item prices for conversion rates and sales, automatically reconciling sales, tax, commission, marketing and fees across platforms to identify (and hopefully not introduce new) errors.

Superorder clearly has its fingers in lots of pies — and competes with lots of startups as a result. Poddar sees Nextbit, Virtual Dining Concepts and Ordermark as Superorder’s main rivals, but one could argue that the firm also goes head to head with ghost kitchen companies including MadEats, CloudEats and Lunchbox — at least on the digital asset management side.

But New York City-based Superorder is slowly but surely growing since emerging from Y Combinator’s Summer 2019 cohort. With a staff of about 70 people, it now operates in over 180 cities across the U.S. with more than 1,500 restaurant customers and has facilitated around 1.5 million orders to date.

There’s lots of money in the market besides — more than enough to go around, one would presume. A recent report estimates that the market for online food delivery will grow from $160 billion in 2022 to $483 billion by 2032.

Poddar says that the plan is to use Superorder’s new round of funding to expand the company’s operations, sales and engineering teams.

“In addition to scaling customers, we will also expand our product offering to become the full off-premise operating system for restaurants,” Poddar said. “We’re working on expanding further into the restaurant software stack and become the all-in-one software platform that gives restaurants the tools needed to drive profitability from delivery and takeout.”